1. Commitment Devices: Using Initiatives to Change Behavior (Rogers et al. 2014)

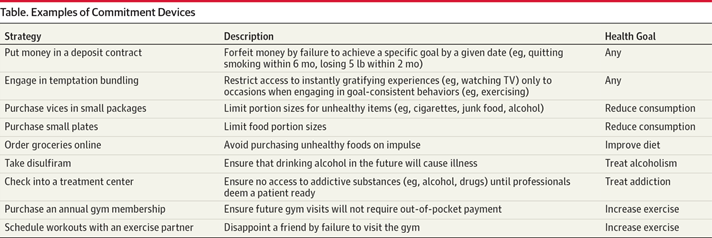

"Unhealthy behaviors are responsible for a large proportion of health care costs and poor health outcomes.1 Surveys of large employers regularly identify unhealthy behaviors as the most important challenge to affordable benefits coverage. For this reason, employers increasingly leverage incentives to encourage changes in employees’ health-related behaviors. According to one survey, 86% of large employers provide incentives for healthy behavior change.2 In this Viewpoint, we discuss the potential and limitations of an approach that behavioral science research has shown can be used to influence health behaviors but that is distinct from incentives: the use of commitment devices"

2. A fine nudge? Singapore MRT vs London Tube.

3. There's a new Masters program in Behavioural Economics - this one in City University London.

4. Video of George Loewenstein and Rory Sutherland in conversation last week at the London Behavioural Economics Monthly Meetup (aka Boozeonomics): Part 1 (55min), Part 2 (5min), transcript.

Wednesday, April 30, 2014

Friday, April 25, 2014

SGPE Python Programming Course

Posted by

Liam Delaney

Dear Colleagues

I am writing to invite you to participate in the 2nd annual SGPE Python Boot Camp to be held the week of 2-6 June 2014 from 9am - 5pm at the University of Edinburgh (exact location TBD depending on interest).

The Python boot camp is an intensive week long training course in Python programming and software development primarily targeted at students doing a PhD in Economics or who have a computational component to their MSc theses. The curriculum mainly follows Think Python by Allen Downey and Quantitative Economics by Thomas Sargent and John Stachurski. The entire curriculum for the course can be found on GitHub.

Note that this is NOT a lecture based course and there are no notes/slides. Participants will be learning to program in Python by writing code...LOTS of code...probably several thousand lines of code at least! This is not meant to scare anyone off, only to give you a realistic impression of what you are signing up for.

Morning sessions will focus on the basics of Python programming; afternoon sessions are devoted to more specialized topics that you would likely want to use as part of your MSc thesis (or future PhD/job work). For those who attended last year, note that the afternoon sessions will cover different material than last year's course.

To register your interest, please add your name to the Doodle poll.

This activity received SIRE funding and PhD students travelling from outside of Edinburgh may claim travel expenses from SGPE.

The claim form is available from the SGPE website

Please contact David R. Pugh (drobert.pugh@gmail.com) for any inquiries.

Thursday, April 24, 2014

PhD Studentship: Time discounting risk preference, personal health behaviours and screening in older people

Posted by

Liam Delaney

Excellent PhD opportunity at Queen's University Belfast

The Northern Ireland Cohort for the Longitudinal Study of Aging (NICOLA) uses a series of follow-up interviews of a random sample of 8500 people over 50. NICOLA will study important aspects of ageing and health. This project will use data linkages within NICOLA and other sources to explore behavioural economic theories which relate data on individual respondent’s time and risk preferences to health related behaviours in the areas of mental and physical health and wellbeing, such as smoking, alcohol consumption, obesity, physical activity and compliance in health screening programs. This economic data can be used to identify classes of respondents likely to engage in unhealthy behaviours and for whom special incentives and initiatives may be designed.

The Northern Ireland Cohort for the Longitudinal Study of Aging (NICOLA) uses a series of follow-up interviews of a random sample of 8500 people over 50. NICOLA will study important aspects of ageing and health. This project will use data linkages within NICOLA and other sources to explore behavioural economic theories which relate data on individual respondent’s time and risk preferences to health related behaviours in the areas of mental and physical health and wellbeing, such as smoking, alcohol consumption, obesity, physical activity and compliance in health screening programs. This economic data can be used to identify classes of respondents likely to engage in unhealthy behaviours and for whom special incentives and initiatives may be designed.

Thursday, April 17, 2014

John Bates Clark Medal 2014 winner

Posted by

Unknown

Matthew Gentzkow of Chicago University is this year's winner of the John Bates Clark medal. The JBC, awarded biennially from 1947-2009 and annually thereafter, is awarded to the "American economist under the age of forty who is judged to have made the most significant contribution to economic thought and knowledge". The JBC is often considered an early-career version of an economics Nobel - you can see the list of past winners here, many of whom went on to win a Nobel later.

"Matthew Gentzkow has made fundamental contributions to our understanding of the economic forces driving the creation of media products, the changing nature and role of media in the digital environment, and the effect of media on education and civic engagement. He has thus emerged as a leader in a new generation of microeconomists applying economic methods to analyze questions that were historically analyzed by non-economists. His empirical work combines novel data, innovative identification strategies and careful empirical methods to answer questions at the interface of economics, political science, and sociology. This work is complemented by significant theoretical work on information, communication, and persuasion. Gentzkow, both on his own and in collaboration with his frequent co-author, Jesse Shapiro, has played a primary role in establishing a new and extremely promising empirical literature on the economics of the news media."

Click to read the press release discussing his work further.

"Matthew Gentzkow has made fundamental contributions to our understanding of the economic forces driving the creation of media products, the changing nature and role of media in the digital environment, and the effect of media on education and civic engagement. He has thus emerged as a leader in a new generation of microeconomists applying economic methods to analyze questions that were historically analyzed by non-economists. His empirical work combines novel data, innovative identification strategies and careful empirical methods to answer questions at the interface of economics, political science, and sociology. This work is complemented by significant theoretical work on information, communication, and persuasion. Gentzkow, both on his own and in collaboration with his frequent co-author, Jesse Shapiro, has played a primary role in establishing a new and extremely promising empirical literature on the economics of the news media."

Click to read the press release discussing his work further.

Tuesday, April 15, 2014

Consumer credit and consumers in vulnerable circumstances

Posted by

Liam Delaney

Recent report from the Financial Conduct Authority - summary below:

To understand more about the experiences of consumers most at risk of unmanageable debt, we have conducted primary research looking at the attitudes towards, and use of, credit for people on the lowest incomes.

What did we look at?

Our research identifies three distinct borrower groups – survival borrowers, lifestyle borrowers, and reluctant borrowers – and explores how these groups use credit and the reasons for doing so. Our research also shows how debts can become unmanageable, and the strategies people use to cope with spiralling debts, showing how unmanageable debt triggers both financial detriment and affects health and wellbeing.

While many of the people we interviewed had low awareness of the help and support available to them, debt advice is effective in helping people get out of unmanageable debt. So helping people get the right advice and solution they need, before debt gets out of control, is vital. As we take over the regulation of this sector, we welcome a broader debate with stakeholders to encourage more people to get access to good quality advice earlier, before they reach crisis point.

Monday, April 14, 2014

INET's Human After All conference

Posted by

Unknown

The Institute for New Economic Thinking annual conference took place in Toronto last week with many well-known speakers from economics and other disciplines. The title of the conference was "Human After All" focused on the theme of innovation and its impact on economics so far. Guest speakers included Larry Summers, Joe Stiglitz, James Heckman, Michael Sandel, Adair Turner and many others. The highlight of the videos I've seen so far is Michael Sandel on "What Money Can't Buy".

Click this page to see INET's uploaded videos from the conference.

Click this page to see INET's uploaded videos from the conference.

Saturday, April 12, 2014

Clive Walker Seminar Wednesday 2pm

Posted by

Liam Delaney

Clive Walker from Queen's University Belfast will give our Wednesday 2pm seminar on 16th April in Room 2B86.

The Causality of Media Influence: Real Estate News and the Stock Market

This article investigates the nature of news media influence in the stock market using a method that circumvents the causality issues usually prevalent in the study of media and markets. I find that real estate news in the Financial Times exhibits a significant robust relationship with the return premium of stocks of companies involved in the housing market. Since stock market changes do not cause reporting to change the casual effect of media is significant.

The Causality of Media Influence: Real Estate News and the Stock Market

This article investigates the nature of news media influence in the stock market using a method that circumvents the causality issues usually prevalent in the study of media and markets. I find that real estate news in the Financial Times exhibits a significant robust relationship with the return premium of stocks of companies involved in the housing market. Since stock market changes do not cause reporting to change the casual effect of media is significant.

Links of the Week 12.4.14

Posted by

Unknown

1. Campbell et al. (2014), Early Childhood Investments Substantially Boost Adult Health, Science

Abstract: We report on the long-term health effects of one of the oldest and most heavily cited early childhood interventions with long-term follow-up evaluated by the method of randomization: the Carolina Abecedarian Project (ABC). Using recently collected biomedical data, we find that disadvantaged children randomly assigned to treatment have significantly lower prevalence of risk factors for cardiovascular and metabolic diseases in their mid-30s. The evidence is especially strong for males. The mean systolic blood pressure among the control males is 143 millimeters of mercury (mm Hg), whereas it is only 126 mm Hg among the treated. ...Our evidence shows the potential of early life interventions for preventing disease and promoting health.

The most striking stat from this paper: 25% of people in the control group had metabolic syndrome (a cluster of risk factors that are predictive of heart disease, diabetes and other serious ailments) compared to, incredibly, 0% in the treatment group.

2. Paul Krugman reviews Piketty's 'Capital' in the NYRB

3. A graph based on the research of Fionnuala O'Reilly, one of the MSc students here, showing the correlation between trust in others and self-reported happiness in the European Social Survey. Both are scored 1-10 but the range is trimmed here.

4. Some stirring work by another MSc student Adam Connolly - a remix of Aphex Twin and the 'Linda problem' from the audiobook version of Thinking, Fast and Slow.

Abstract: We report on the long-term health effects of one of the oldest and most heavily cited early childhood interventions with long-term follow-up evaluated by the method of randomization: the Carolina Abecedarian Project (ABC). Using recently collected biomedical data, we find that disadvantaged children randomly assigned to treatment have significantly lower prevalence of risk factors for cardiovascular and metabolic diseases in their mid-30s. The evidence is especially strong for males. The mean systolic blood pressure among the control males is 143 millimeters of mercury (mm Hg), whereas it is only 126 mm Hg among the treated. ...Our evidence shows the potential of early life interventions for preventing disease and promoting health.

The most striking stat from this paper: 25% of people in the control group had metabolic syndrome (a cluster of risk factors that are predictive of heart disease, diabetes and other serious ailments) compared to, incredibly, 0% in the treatment group.

2. Paul Krugman reviews Piketty's 'Capital' in the NYRB

3. A graph based on the research of Fionnuala O'Reilly, one of the MSc students here, showing the correlation between trust in others and self-reported happiness in the European Social Survey. Both are scored 1-10 but the range is trimmed here.

4. Some stirring work by another MSc student Adam Connolly - a remix of Aphex Twin and the 'Linda problem' from the audiobook version of Thinking, Fast and Slow.

Friday, April 11, 2014

Nudge Database XI

Posted by

Unknown

See the left-hand column for links to previous editions of the Nudge Database.

101. The authors tested a voluntary self-control commitment device to help grocery shoppers in South Africa make healthier food purchases. The shoppers in this experiment, were already enrolled in a large-scale incentive program that discounted the price of eligible groceries by 25%, could risk their discount as a motivational tool.

Of the total sample of 4,073 households, 632 chose to enter the commitment program. They pledged to increase their purchases of healthy food by 5 percentage points above their household baseline for each of 6 months. If they reached that goal, their discount was awarded as usual; otherwise, their discount was forfeited for that month. This ‘committed’ group showed an average 3.5-percentage-point increase in healthy grocery items purchased in each of the 6 months; households that declined the commitment ("Noncommited", N= 2,112) and control-group (N=1,329) households that were given a hypothetical option to precommit did not show such an increase.

Schwartz et al. (2014), Healthier by Precommitment, Psychological Science

102. This

trial to encourage healthier grocery purchases ran for 5 weeks from 13 May 2013

in a Morrison’s store in Manchester. The store was decorated with a variety of

displays, such as a cutout of the area’s local doctor (pictured), at

strategically placed locations to prime the idea of healthier shopping.

102. This

trial to encourage healthier grocery purchases ran for 5 weeks from 13 May 2013

in a Morrison’s store in Manchester. The store was decorated with a variety of

displays, such as a cutout of the area’s local doctor (pictured), at

strategically placed locations to prime the idea of healthier shopping.

Data for a list of target foods was collected for the five weeks before, during and after the experiment, providing 15 weeks of data in total. Comparative data from five other control stores were gathered for the same period. Preliminary analysis indicates the intervention was successful at increasing fruit purchases.

105. Before 1997, students in the US applying for universities could send reports of their test scores to three colleges for free. An additional report cost $6 to send. In 1997, the rule was changed to increase the number of free reports to four, causing the number of people sending four reports to jump from 3% to 74%.

105. Before 1997, students in the US applying for universities could send reports of their test scores to three colleges for free. An additional report cost $6 to send. In 1997, the rule was changed to increase the number of free reports to four, causing the number of people sending four reports to jump from 3% to 74%.

The author finds that the biggest benefit from this policy tweak was that after 1997, low-income students became more likely to apply to, and attend, more selective colleges. The lower-income students attending these colleges received a significant increase in their expected earnings.

101. The authors tested a voluntary self-control commitment device to help grocery shoppers in South Africa make healthier food purchases. The shoppers in this experiment, were already enrolled in a large-scale incentive program that discounted the price of eligible groceries by 25%, could risk their discount as a motivational tool.

Of the total sample of 4,073 households, 632 chose to enter the commitment program. They pledged to increase their purchases of healthy food by 5 percentage points above their household baseline for each of 6 months. If they reached that goal, their discount was awarded as usual; otherwise, their discount was forfeited for that month. This ‘committed’ group showed an average 3.5-percentage-point increase in healthy grocery items purchased in each of the 6 months; households that declined the commitment ("Noncommited", N= 2,112) and control-group (N=1,329) households that were given a hypothetical option to precommit did not show such an increase.

The authors say these results suggest

self-aware consumers will seize opportunities to create restrictive choice

environments for themselves, even at some risk of financial loss.

Schwartz et al. (2014), Healthier by Precommitment, Psychological Science

102. This

trial to encourage healthier grocery purchases ran for 5 weeks from 13 May 2013

in a Morrison’s store in Manchester. The store was decorated with a variety of

displays, such as a cutout of the area’s local doctor (pictured), at

strategically placed locations to prime the idea of healthier shopping.

102. This

trial to encourage healthier grocery purchases ran for 5 weeks from 13 May 2013

in a Morrison’s store in Manchester. The store was decorated with a variety of

displays, such as a cutout of the area’s local doctor (pictured), at

strategically placed locations to prime the idea of healthier shopping. Data for a list of target foods was collected for the five weeks before, during and after the experiment, providing 15 weeks of data in total. Comparative data from five other control stores were gathered for the same period. Preliminary analysis indicates the intervention was successful at increasing fruit purchases.

Edwards

(2013), Healthier Choices Pilot.

103. The authors used a natural field experiment to test people's tendency to stick with the

default option on printers by switching the printers'

default settings in a large Swedish university from single to double page printing.

The results are dramatic - one third of all printing is

determined by the default alternative, and hence daily paper consumption drops

by 15 percent due to the change. The effect is immediate, lasts throughout the

experimental period, and remains intact after six months.

Egebark & Ekström (2013), Can Indifference Make the World Greener?, Research Paper

104. The

authors examine how taking a financial survey affects future financial

decision-making. By exploiting randomized assignment to survey modules in the LISS

Panel (a nationally representative panel study of the Dutch population), they

find that households who respond to detailed questions on expenditures and

needs in retirement reduced their non-household saving rate by an average of 3.5

percentage points. This effect is driven by high-educated, high-wealth

households and is possibly due a salience

shock, i.e. the people taking the survey didn’t realize they that were

saving more than necessary until they took the survey.

Crossley

et al. (2014), Can Survey

Participation Alter Household Financial behavior?, IFS Working Paper.

105. Before 1997, students in the US applying for universities could send reports of their test scores to three colleges for free. An additional report cost $6 to send. In 1997, the rule was changed to increase the number of free reports to four, causing the number of people sending four reports to jump from 3% to 74%.

105. Before 1997, students in the US applying for universities could send reports of their test scores to three colleges for free. An additional report cost $6 to send. In 1997, the rule was changed to increase the number of free reports to four, causing the number of people sending four reports to jump from 3% to 74%.The author finds that the biggest benefit from this policy tweak was that after 1997, low-income students became more likely to apply to, and attend, more selective colleges. The lower-income students attending these colleges received a significant increase in their expected earnings.

Pallais (2013), Small Differences that Matter:Mistakes in Applying to College, NBER Working Paper

106. The authors analyze the

effectiveness of the the 2009 Credit Card

Accountability Responsibility and Disclosure (CARD) Act on consumer

financial regulation. Using a panel data set covering over 150 million credit

card accounts, they find that regulatory limits on credit card fees reduced

overall borrowing costs to consumers by an annualized 2.8% of average daily

balances, with a decline of more than 10% for consumers with the lowest credit

scores.

Consistent with a model of

low fee salience and limited market competition, they find no evidence of an

offsetting increase in interest charges or a reduction in access to credit.

Taken together, they estimate that the CARD Act fee reductions have saved U.S.

consumers $20.8 billion per year.

They also analyzed the CARD

Act requirement to disclose the interest savings from paying off balances in 36

months rather than only making minimum payments. They find that this

"nudge" increased the number of account holders making the 36-month

payment value by 0.5 percentage points, with a similarly sized decrease in the

number of account holders paying less than this amount.

Agarwal et al. (2013), Regulating Consumer Financial Products: Evidence from Credit Cards, NBER Working Paper

107. The authors examine the effects of receipts that included personalized ordering suggestions designed

to reduce unhealthy food choices at a restaurant

chain. They find that customers made most of the item

substitutions that were encouraged by the messages, such as substituting ham

for sausage in a breakfast sandwich, or substituting frozen yogurt for ice

cream, though effects on overall calories and fat consumed were small. The

results illustrate the potential of emerging information technologies, which

allow retailers to tailor product marketing to individual consumers, to

contribute in meaningful new ways to the battle against obesity.

107. The authors examine the effects of receipts that included personalized ordering suggestions designed

to reduce unhealthy food choices at a restaurant

chain. They find that customers made most of the item

substitutions that were encouraged by the messages, such as substituting ham

for sausage in a breakfast sandwich, or substituting frozen yogurt for ice

cream, though effects on overall calories and fat consumed were small. The

results illustrate the potential of emerging information technologies, which

allow retailers to tailor product marketing to individual consumers, to

contribute in meaningful new ways to the battle against obesity.

The reciprocity message was the most effective treatment, increasing the number of donors over the 5 week period by 1,203 compared to the control. This increase extrapolates to around 96,000 more signups per year.

107. The authors examine the effects of receipts that included personalized ordering suggestions designed

to reduce unhealthy food choices at a restaurant

chain. They find that customers made most of the item

substitutions that were encouraged by the messages, such as substituting ham

for sausage in a breakfast sandwich, or substituting frozen yogurt for ice

cream, though effects on overall calories and fat consumed were small. The

results illustrate the potential of emerging information technologies, which

allow retailers to tailor product marketing to individual consumers, to

contribute in meaningful new ways to the battle against obesity.

107. The authors examine the effects of receipts that included personalized ordering suggestions designed

to reduce unhealthy food choices at a restaurant

chain. They find that customers made most of the item

substitutions that were encouraged by the messages, such as substituting ham

for sausage in a breakfast sandwich, or substituting frozen yogurt for ice

cream, though effects on overall calories and fat consumed were small. The

results illustrate the potential of emerging information technologies, which

allow retailers to tailor product marketing to individual consumers, to

contribute in meaningful new ways to the battle against obesity.

Bedard

& Kuhn (2013), Making Nutritional Information

Digestible: Effects of a Receipt-Based Intervention on Restaurant Purchases, NBER Working Paper

108. The authors conducted a 2 year experiment in Chile designed to increase savings behaviour. Specifically they tested the effectiveness of weekly self-help style peer group meetings, text message reminders and the more traditional approach of a high interest account paying 5% (instead of the standard 0.3%).

Surprisingly the high interest rate had no effect on the savings behaviour of most people. Those in the peer groups (which involved announcing their savings targets to other members) deposited money 3.5 times more often and weekly text message reminders (operating like a virtual savings buddy) were almost as effective.

Kast et al. (2012), Under-Savers Anonymous: Evidence

on Self-Help Groups and Peer Pressure as a Savings Commitment Device, IZA

Discussion Paper

109. The authors tested the efficacy of self-declared deadlines as a commitment device (N= 99 MIT students). While the control group received evenly spaced deadlines to complete three papers (about one paper a month), the treatment group were free to choose their own deadlines. There was no bonus or teacher feedback for early completion of papers so there wasn't an incentive to complete one paper quickly in order to improve later ones.

A rational response would seem to be to declare all three of your paper deadlines for the last possible day - in fact only 27% of students did this. The no-choice group ended up getting better grades than the self-declared deadline group(88.7 v 85.6, p=0.003) and the no choice group also did better on a project that was also due on the final day (86 v 77, p < 0.01).

Ariely & Wertenbroch (2002), Procrastination, deadlines, and performance: Self-control by precommitment, Psychological Science

110. Motivated by the fact that 9 out of

10 people support organ donation but less than 1 in 3 register as donors, the

Behavioural Insights Team ran an RCT in conjunction with NHS Blood and

Transport and other agencies. The trial ran for 5 weeks on a gov.uk website with a sample size of over 1 million.

After renewing their vehicle tax or registering for a driving license, the website users proceeded to either a 'control' page saying "Thank you. Please join the NHS Organ Donor Register" or one of many different 'treatment' pages which modified the message slightly using principles of social norms ("Every day thousands of people who see this page decide to register"), loss framing ("Three people die every day because there are not enough organ donors"), reciprocity ("If you needed an organ transplant would you have one? If so please help others") and others.

The reciprocity message was the most effective treatment, increasing the number of donors over the 5 week period by 1,203 compared to the control. This increase extrapolates to around 96,000 more signups per year.

The Behavioural Insights Team, Applying Behavioural Insights to Organ Donation

New BIT publication

Posted by

Unknown

The Behavioural Insights Team have a new publication out called "EAST: Four Simple Ways to Apply Behavioural Insights". "EAST" is short for "Easy, Attractive, Social and Timely" and is intended as a guide for policy-makers interested in applying behavioural insights.

Download the report here.

Download the report here.

Wednesday, April 09, 2014

European Nudge Network Conference June 27 in Copenhagen

Posted by

Unknown

The research group iNudgeyou, mentioned recently on the blog for their field experiment in Copenhagen airport, will hold a one-day conference in Copenhagen on June 27, 2014 on the topic of "5 Years of Applied Behavioural Science in Public Policy". The keynote speaker is Cass Sunstein and the other speakers have not yet been announced.

This is also the inaugural conference of 'The European Nudge Network', described below:

"The aim of the conference is to take stock of the first 5 years of The New Policy ABsC by gathering for the first time all European actors involved in applying behavioural sciences to policymaking. The event is also set to launch The European Nudge Network – a platform for accelerating information dissemination and collaboration across Europe based on the template of the successful Danish Nudging Network. ....We encourage policy makers, civil servants, academics, businesses, organizations and other stakeholders across Europe to attend the conference."

Click here to learn more about the conference and sign up to attend.

This is also the inaugural conference of 'The European Nudge Network', described below:

"The aim of the conference is to take stock of the first 5 years of The New Policy ABsC by gathering for the first time all European actors involved in applying behavioural sciences to policymaking. The event is also set to launch The European Nudge Network – a platform for accelerating information dissemination and collaboration across Europe based on the template of the successful Danish Nudging Network. ....We encourage policy makers, civil servants, academics, businesses, organizations and other stakeholders across Europe to attend the conference."

Click here to learn more about the conference and sign up to attend.

The BIT are hiring

Posted by

Unknown

http://behaviouralinsights.co.uk/blogpost/we-are-recruiting-behavioural-insights-research-centre-english-and-maths-bircem

"We are now recruiting Senior Advisors for the Behavioural Insights Research Centre for English and Maths (BIRCEM). We are looking for exceptional candidates with relevant academic expertise and a proven track record of delivering research projects (particularly Randomised Controlled Trials) involving multiple stakeholders. We are especially keen to receive applications from those with a demonstrable passion for using behavioural science to improve the lives of those who did not succeed at school."

"We are now recruiting Senior Advisors for the Behavioural Insights Research Centre for English and Maths (BIRCEM). We are looking for exceptional candidates with relevant academic expertise and a proven track record of delivering research projects (particularly Randomised Controlled Trials) involving multiple stakeholders. We are especially keen to receive applications from those with a demonstrable passion for using behavioural science to improve the lives of those who did not succeed at school."

Tuesday, April 08, 2014

Wellbeing and Policy report from the Legatum Institute

Posted by

Unknown

The Legatum Institute recently released "Wellbeing and Policy", a 96 page document aimed at advancing the debate on how wellbeing data can be used to improve public policy. The authors of the report are the former head of the Civil Service Lord Gus O'Donnell, Professor Angus Deaton of Princeton University, Martine Durand of the OECD, Dr. David Halpern of the Behavioural Insights Team and Lord Layard of LSE.

The report is quite detailed and worth reading. Among many other things, it discusses the issues around measuring wellbeing, the three broad concepts of life satisfaction, positive affect and eudaimonia (psychological 'flourishing' or having a sense of meaning in life) and offers concrete suggestions for how measurements of wellbeing should inform policy decisions (example below).

Below is a video featuring the authors discussing the report.

The report is quite detailed and worth reading. Among many other things, it discusses the issues around measuring wellbeing, the three broad concepts of life satisfaction, positive affect and eudaimonia (psychological 'flourishing' or having a sense of meaning in life) and offers concrete suggestions for how measurements of wellbeing should inform policy decisions (example below).

Below is a video featuring the authors discussing the report.

Monday, April 07, 2014

The financial crisis and its effects: Perspectives from economics and psychology

Posted by

Liam Delaney

Short communication by Greenglass et al in the Journal of Behavioural and Experimental Economics. The conclusion is below:

Countries across the globe vary in the extent to which they have been affected by the recent financial crisis. There was a consensus among the panelists that despite signs of economic recovery, income inequality remains a concern. The benefits of economic growth flow largely to the already wealthy. Economic recovery cannot occur until an economy can generate more paying jobs, and with them, increased consumer confidence and spending. Austerity programs implemented by many governments worldwide to cope with the financial crisis have had the opposite effect, namely to reduce jobs and correspondingly to reduce consumer confidence and spending by individuals and governments alike. The economically deleterious and psychologically harmful effects of unemployment are a distinct concern, particularly for many youth of our day. As youth unemployment is often double the national average today in many countries, there are associated economic, social and psychological issues. These can lead to widespread suffering in the short term and may have negative long-term effects on a societal level. The longer these levels of unemployment persist, the more difficult it will be for countries to manage societal discontent. The panel discussion summarized here highlights the importance of bringing together psychologists and economists to study and analyze the financial crisis and its effects.

This one goes up to eleven

Posted by

Liam Delaney

The issue of scaling in surveys comes up a lot here in research and lectures. Kevin Denny reminded me of this classic gag from Spinal Tap. A nice reminder that the numbers themselves are not necessarily meaningful.

Sunday, April 06, 2014

Behavioural Economics and Constitutional Change

Posted by

Liam Delaney

One of the ongoing projects in our research centre is a contribution to a wider ESRC centre on Constitutional Change in Scotland. This piece co-authored by myself and Ailsa Henderson, Professor of Political Science at Edinburgh University, outlines how behavioural economics contributes to an understanding of the referendum voting process.

The upcoming referendum on 18th September in Scotland involves the people of Scotland making the choice of remaining within the UK or becoming an independent country. The referendum question itself asks simply:

“Should Scotland be an Independent country?”

Many arguments for and against this proposition have been marshalled and repeated through the media over the last year. The Yes side argue that an Independent Scotland would have greater autonomy to create a society more suited to the needs of Scottish people, that they would be able to better invest oil and other revenues, have independence in military matters and many other potential benefits. Conversely the no-side argue that the move would be risky in terms of breaking up an existing union that is working, that it would create problems in terms of Scotland’s currency arrangements and membership of the EU and that it would create security problems, again among many other arguments. Regardless of the merits of the arguments of both sides, a key factor in the outcome will be how people perceive risk and how they are willing to take risks.

Christopher Boyce on Money and Well-Being

Posted by

Liam Delaney

Centre researcher Christopher Boyce writes here on the link between money and well-being.

"How important, if at all, is having more money for our happiness and well-being? Unsurprisingly this question stimulates a lot of opinion and debate. But are people accurate in their predictions about the benefits of having money?"

"How important, if at all, is having more money for our happiness and well-being? Unsurprisingly this question stimulates a lot of opinion and debate. But are people accurate in their predictions about the benefits of having money?"

Behavioural Economics and UK Annuities Shake-Up

Posted by

Liam Delaney

A piece I wrote for the Conversation UK on this topic is available here and reproduced below:

The recent budget announcement providing freedom for retirees to decide how to allocate their own pension pots was a bold and surprising move.

However, a number of issues are clearly opened by this policy. The first is squarely in the realm of standard economics and was pointed out by Carl Emerson at the Institute for Fiscal Studies budget briefing. Left to their own devices people with low life expectancies are, on balance, better off not being in annuities schemes. This leads to an “adverse selection” effect where only those with a high life expectancy will chose to stay in, making the funds ultimately difficult to sustain.

Moving to the less traditional realm of behavioural economics there are clearly many potential issues with how people make these types of complex financial decisions.

Indeed the abysmally low levels of defined contribution pension participation in the first place led to the introduction of auto-enrolment in the private sector which has been continuing apace throughout the last year.

While auto-enrolment does preserve an element of choice for individuals in that they can still choose to opt out, the defaults are very strongly set and people are automatically re-enrolled two years after their first opt-out. Substantial guidance and support has been provided to both firms and individuals in choosing default funds that are suitable for people’s characteristics.

Initial indications are that the vast majority of people are responding to the new defaults by staying in their pension schemes. Indeed one issue the government will face is the possibility that individuals who might have saved higher amounts without the default will “stick” at the level they have been allocated. With this in mind, there will be active attempts to encourage individuals to escalate their rates of saving through time.

Given the government has been so active in encouraging people to save more, it seems strange to reduce the intervention at the other end of the cycle.

It could be argued that early intervention is important to compensate for inexperience and to get people in the habit of saving. After all, with age comes wisdom, and a better appreciation of personal finances. Perhaps retirees can be expected to suffer less from biases that might influence younger people?

This is unlikely, however. There are many reasons why people may be poor at planning from retirement to death.

Underestimating life expectancy and the costs of long-term care is a key factor and one that will drive individual decisions. People also tend not to pay enough attention to the fees financial firms charge them, and thus end up with lower returns than would be expected in a truly rational market.

Furthermore, people tend to invest in a narrow range of assets they can understand clearly such as property, stock market funds or even just leaving money in low-interest deposit accounts.

The government has partly acknowledged these issues by introducing one-to-one impartial advice sessions for retirees. But it is unlikely such sessions will be able to override the problems arising from a large number of inexperienced investors suddenly arriving onto the market.

The striking increase in pension participation among auto-enrolled employees – 2.9m signups since October 2012 – highlights the futility of many of the attempts to improve pension participation through advice and information that preceded it. Just as people know smoking is bad for you, the fact that saving is a sound long-term strategy is well known; however acting on this proves difficult for many individuals due to the complexity involved.

Some say that attempts to restrain an individual’s choice of how to spend their pension pot is disrespectful towards their freedom. But this is a facile argument. Under the announced policy the government will already tax money taken from pension pots and it is no more intrusive to seek to regulate what might happen in the new market created by the budget announcement.

The implications for long-term care provision are particularly worrying. What happens if, or when, a large number of retirees are lured into very low-return or risky investments through confusion and predatory third-party marketing – who will pay for their care?

The Financial Conduct Authority (FCA) should set very clear guidelines on the type of products that can be offered to people as default retirement funds, and it must enforce strict rules on how fees, risks and rates are communicated to individuals.

The fact people differ markedly in their ability to make good financial decisions has been absent from policy and behavioural economics discussions for many years. If the government’s proposed one-to-one consultation initiative is to be effective it must recognise this.

Clearly, some retirees will use the freedom provided by the chancellor’s announcement to successfully seek higher value returns than they had previously been receiving. But those others who need far more than a simple advice session must not be ignored.

Both government policy and practical advice needs to recognise the many different types of retirees out there and be tailored accordingly. A blunt one-size-fits-all pensions policy risks simply handing financial companies easy profits at the expense of real financial stability for many households.

Saturday, April 05, 2014

FCA behavioural experiments on insurance add-ons

Posted by

Liam Delaney

I blogged before about the UK Financial Conduct Authority's (FCA) initial work on behavioural economics applied to regulation. They have recently released another interesting and important study on the behavioural economics of insurance add-ons (Thanks to Zanna Iscenko for emailing these). Details of the studies are available below, including a short version. The key finding of the study is below showing that the format of how product insurance is sold has a substantial effect on consumers' ability to find value. While the experiments are on hypothetical products it provides important initial information on how these markets might be functioning. It is clear that this type of applied behavioural research in regulatory contexts is going to grow substantially over the next decade.

Iscenko, Z., Duke, C., Huck, S. and Wallace, B. (2014) How does selling insurance as an add-on affect consumer decisions? A practical application of behavioural experiments in financial regulation, FCA Occasional Paper 3. http://www.fca.org.uk/static/documents/occasional-papers/occasional-paper-3.pdf

A short graphic on some of the key results of the experiment can be found here: http://www.fca.org.uk/static/documents/occasional-papers/occasional-paper-3-graphic.pdf

Further technical details on the analysis of the findings can be found at:

London Economics (2014) Study into the sales of Add-on General Insurance Products: Experimental consumer research. A report for the FCA. http://www.fca.org.uk/your-fca/documents/market-studies/gi-add-ons-experimental-consumer-research-report

The wider market study can be found here

Iscenko, Z., Duke, C., Huck, S. and Wallace, B. (2014) How does selling insurance as an add-on affect consumer decisions? A practical application of behavioural experiments in financial regulation, FCA Occasional Paper 3. http://www.fca.org.uk/static/documents/occasional-papers/occasional-paper-3.pdf

A short graphic on some of the key results of the experiment can be found here: http://www.fca.org.uk/static/documents/occasional-papers/occasional-paper-3-graphic.pdf

Further technical details on the analysis of the findings can be found at:

London Economics (2014) Study into the sales of Add-on General Insurance Products: Experimental consumer research. A report for the FCA. http://www.fca.org.uk/your-fca/documents/market-studies/gi-add-ons-experimental-consumer-research-report

The wider market study can be found here

Friday, April 04, 2014

Links of the Week (4.4.14)

Posted by

Unknown

1. Tim Harford on Big Data in the FT

2. Edge asks "How has Kahneman's work influenced your own?"

3. van der Klaauw (2014), "From Micro Data to Causality: Forty Years of Empirical Labor Economics", IZA Working Paper

4. An interview with Harvard scholar John Campbell about this year's economics Nobel winners Shiller, Fama and Hansen.

5. The availability heuristic applied to welfare claims in the UK:

"On average people think that 41% of the entire welfare budget goes on benefits to unemployed people - the true figure is 3%... On average people think that 27% of the welfare budget is claimed fraudulently, while the government's own figure is 0.7%."

2. Edge asks "How has Kahneman's work influenced your own?"

3. van der Klaauw (2014), "From Micro Data to Causality: Forty Years of Empirical Labor Economics", IZA Working Paper

4. An interview with Harvard scholar John Campbell about this year's economics Nobel winners Shiller, Fama and Hansen.

5. The availability heuristic applied to welfare claims in the UK:

"On average people think that 41% of the entire welfare budget goes on benefits to unemployed people - the true figure is 3%... On average people think that 27% of the welfare budget is claimed fraudulently, while the government's own figure is 0.7%."

Thursday, April 03, 2014

Coefplot for Stata

Posted by

Unknown

A user-written command for Stata called coefplot was released by Ben Jann recently. It is a very accessible program which can create nice graphs very easily. It is particularly good at working with margins output and seems superior to marginsplot based on my experience with it so far. A particularly nice feature is the ability to combine estimates from several different regressions (example below). The paper is full of examples of the kind of graphs the command can produce and is worth reading.

Subscribe to:

Posts (Atom)